A VA loan is an exclusive, low-cost loan that helps enlisted service members and veterans of the United States military achieve their dream of home ownership. It was established in 1944 to help military service members buy a home after returning from World War II. The Department of Veterans Affairs backs VA loans, typically used to finance up to 100% of a primary residence.

VA Loans vs. Conventional Loans

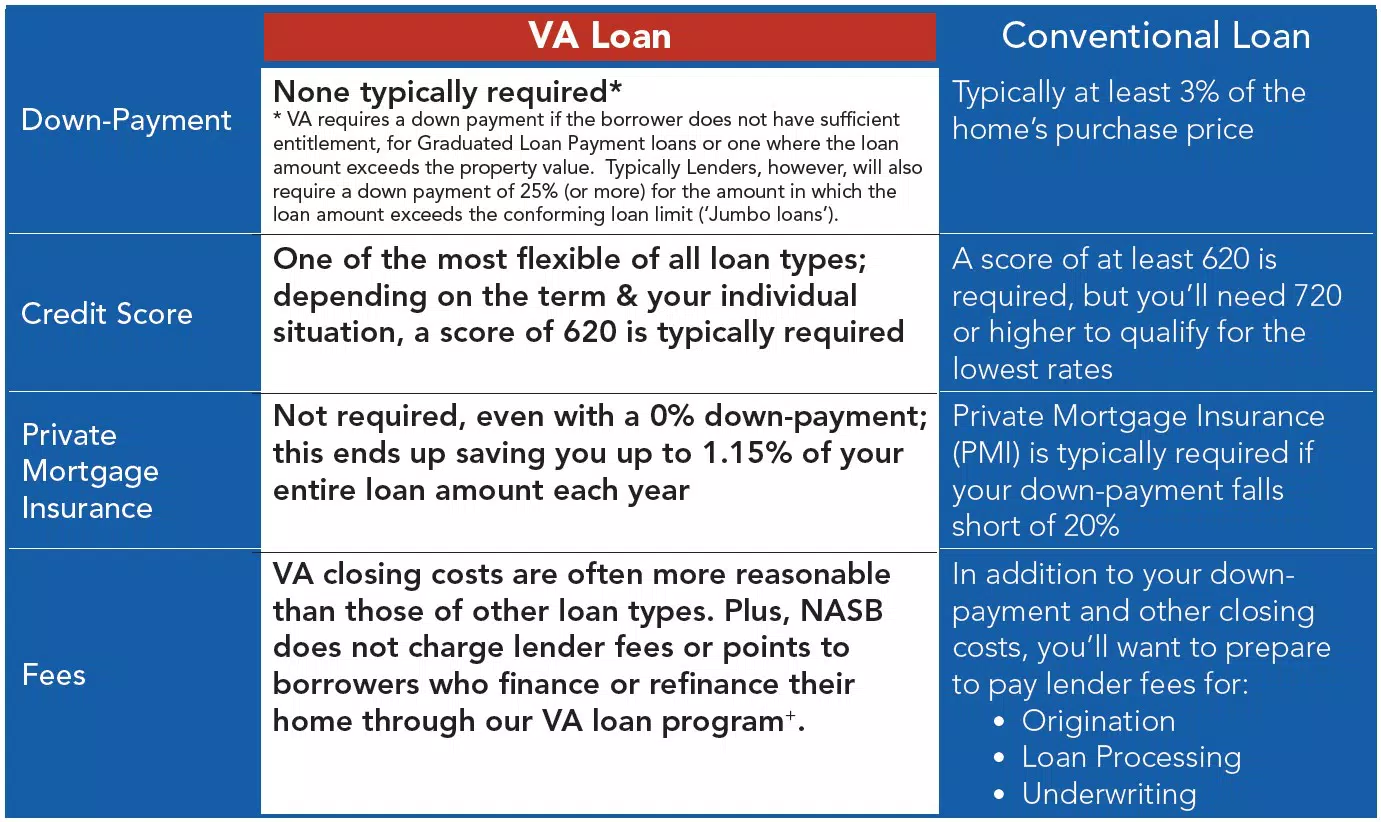

As an active duty service member or veteran, you must be aware of the unique advantages VA loans offer, especially when purchasing your first home. Compare the benefits of a VA loan to those of a conventional loan:

How do VA home loan benefits work?

Eligible VA borrowers may finance up to 100% of the purchase price of a home. Your loan officer would happily discuss your options based on your situation and where you live. Many don’t know that your VA benefits never expire, and you may use your benefits as many times as you wish for future home purchases or refinances. Suppose you own a home that is currently being financed with a VA loan. If you have enough remaining VA eligibility, you may purchase a new primary residence using another VA loan. So, even if you have used most or all of your VA entitlement to purchase a home, your entitlement can be fully restored once you repay your loan in full.

VA loans can be used for:

- 1-4-unit residential purchases (must be a primary residence)

- Interest rate reduction refinancing (IRRRL)

- Cash-out refinancing (any refinance other than IRRRL)

Here's a calculator to help determine your VA loan payments based on the purchased price, down payment, interest rate, military experience, and prior VA loan use. For more information on securing a VA loan, contact a NASB VA-approved lending officer at 888-661-1982 or visit here to learn more about VA loans.

*VA requires a down payment if the borrower has insufficient entitlement for Graduated Loan Payment loans or where the loan amount exceeds the property value.