Mobile Banking App

Get our free Mobile Banking app1 and manage your account on the go – check account balances, transfer funds, and more!

Get our free Mobile Banking app1 and manage your account on the go – check account balances, transfer funds, and more!

Deposit checks without visiting a branch

Easily and securely transfer money

One app for all your accounts

Life moves fast, and getting to a NASB branch isn't always possible. That's why we bring banking to you with the NASB Mobile Banking app. Designed for convenience and ease, our app empowers you to manage your finances anytime, anywhere.

Getting started is simple:

The NASB Mobile Banking app offers a variety of powerful features to help you save time and money.

The Budgets feature can help you set realistic monthly spending limits and avoid exceeding those limits. The Budgets tool draws your eye to the areas that need your attention the most: large bubbles represent a more significant portion of your monthly budget, and red bubbles have exceeded their monthly allowance.

The Spending tool shows you where your money is going by category, helping you better understand your spending habits and stay on track.

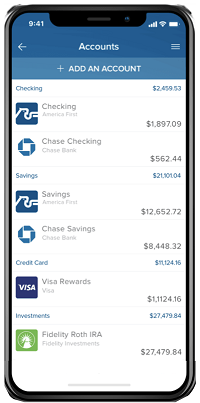

The Accounts tool allows you to monitor financial activity across all your accounts in one place, simplifying your financial tracking. Accounts can be linked from most financial institutions. New users can click the "Add Account” button to add a new account.

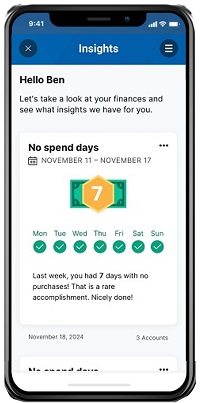

Financial Insights uses artificial intelligence and machine learning to protect, inform, and guide financial decisions with personalized guidance, offers, and recommendations based on behaviors and data. Get spending trends, potential savings opportunities, duplicate payment detection, spend comparisons across categories, financial health scores, and proactive recommendations based on your spending patterns.

a. Over any network to update automatically over cellular data or Wi-Fi.

b. Over Wi-Fi only to update automatically when connected to Wi-Fi.

The following accounts are accessible with NASB Mobile:

Some common reasons checks may not deposit:

1Internet and/or wireless service provider charges may apply.

2In order to access Mobile Banking & Mobile Check Deposit, you must first be enrolled in NASB’s Online Banking and have a current email address on file.